Tax Evasion Penalties Ny . tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment. tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. Tax evasion and fraud may look like:. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range from. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal.

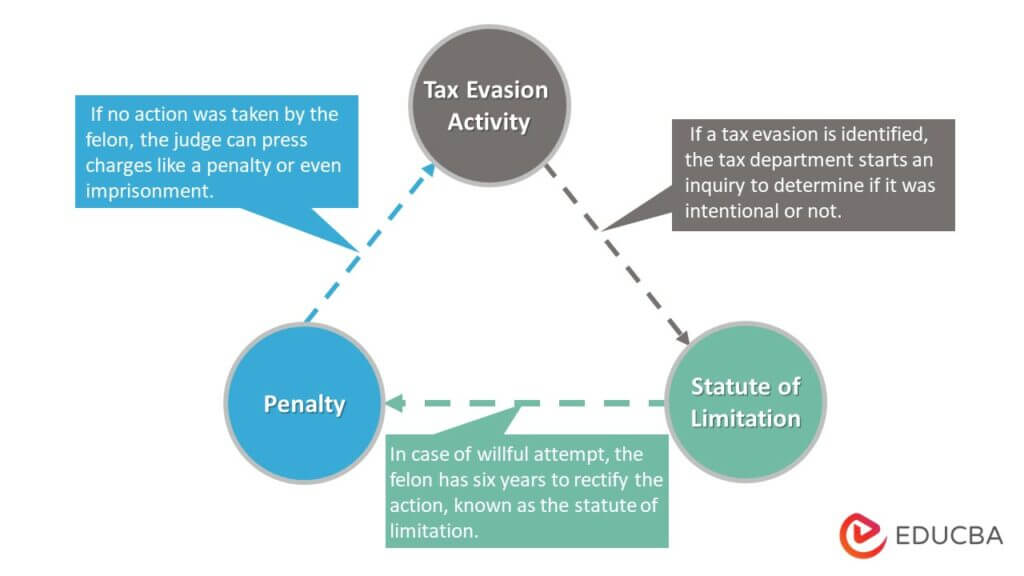

from www.educba.com

tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment. Tax evasion and fraud may look like:. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range from.

Tax Evasion Meaning, Penalty, Examples, & Cases

Tax Evasion Penalties Ny in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment. Tax evasion and fraud may look like:. we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range from. tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment.

From vnexplorer.net

Tax Evasion Know Penalty Before You Evade, Avoid Costly Tax Evasion Penalties Ny tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. Tax evasion and fraud may look like:. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. in the state of new york, tax. Tax Evasion Penalties Ny.

From www.toppers4u.com

Tax Evasion Examples, Penalties & How to Report Tax Evasion Penalties Ny Tax evasion and fraud may look like:. tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. the severity of penalties for tax fraud in new york varies based on the amount. Tax Evasion Penalties Ny.

From www.gobankingrates.com

Crime Doesn't Pay Tax Evasion Penalties Explained GOBankingRates Tax Evasion Penalties Ny the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range from. in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment. tax evasion is a serious crime in new york as it involves deliberately deceiving the. Tax Evasion Penalties Ny.

From business-insolvency-helpline.co.uk

What are the penalties for tax evasion Business Insolvency Helpline Tax Evasion Penalties Ny we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. the severity of penalties for tax fraud in new york varies based on the amount of. Tax Evasion Penalties Ny.

From www.educba.com

Tax Evasion Meaning, Penalty, Examples, & Cases Tax Evasion Penalties Ny we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. Tax evasion and fraud may look like:. in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment. the severity of penalties for tax fraud in new york. Tax Evasion Penalties Ny.

From ceabmsco.blob.core.windows.net

Tax Evasion Penalties Usa at Alicia Ochoa blog Tax Evasion Penalties Ny tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. the severity of penalties for tax fraud in new york varies based on the. Tax Evasion Penalties Ny.

From help.taxreliefcenter.org

IRS Penalties Tax Evasion, Tax Fraud, And Other Tax Crimes Tax Evasion Penalties Ny in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment. tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. Tax evasion and fraud may look like:. the severity of penalties for tax fraud in new york varies based on the amount of. Tax Evasion Penalties Ny.

From taxreliefprofessional.com

Tax Evasion 101 Examples, Penalties, and How to Avoid It at All Costs Tax Evasion Penalties Ny in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment. tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range from. Tax. Tax Evasion Penalties Ny.

From paytm.com

What is Tax Evasion, Common Methods & Penalties for Tax Evasion Tax Evasion Penalties Ny Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range from.. Tax Evasion Penalties Ny.

From www.sydneycriminallawyers.com.au

What Are The Most Common Tax Evasion Penalties? Tax Evasion Penalties Ny tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. Tax evasion and fraud may look like:. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. the severity of penalties for tax fraud in new york varies based on the amount. Tax Evasion Penalties Ny.

From www.toptaxdefenders.com

What Are the Penalties for Tax Evasion? Tax Evasion Penalties Ny we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact. Tax Evasion Penalties Ny.

From scripbox.com

Tax Evasion Meaning, Common Methods and Penalties Tax Evasion Penalties Ny tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. in the state of new york, tax evasion is a criminal offense that can result in both fines and imprisonment. Tax evasion and fraud may look like:. tax evasion or fraud occurs when taxpayers intentionally. Tax Evasion Penalties Ny.

From www.caltaxadviser.com

Tax Evasion Penalties 2024 Milikowsky Tax Law Tax Evasion Penalties Ny Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range from. we need your assistance in identifying individuals who are failing to report their taxes,. Tax Evasion Penalties Ny.

From www.youtube.com

What is Tax evasion and Tax avoidance Meaning Fines and penalties Tax Evasion Penalties Ny we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. Criminal sanctions play an important role in tax administration and the legislature has recognized this fact through its enactment of numerous criminal. Tax evasion and fraud may look like:. the severity of penalties for tax fraud in new. Tax Evasion Penalties Ny.

From klasing-associates.com

Civil Tax Fraud Penalties 101 Everything You Need to Know Tax Evasion Penalties Ny tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range. Tax Evasion Penalties Ny.

From ondemandint.com

Tax Evasion Types & Penalties Explained ODINT Consulting Tax Evasion Penalties Ny we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range from. tax evasion is a serious crime in new york as it involves deliberately deceiving the. Tax Evasion Penalties Ny.

From www.sullivan4irsmatters.com

Tax Evasion Penalties and Tax Fraud Jail Sentences Guide Sullivan Tax Evasion Penalties Ny Tax evasion and fraud may look like:. we need your assistance in identifying individuals who are failing to report their taxes, misrepresenting their income, or engaging in. tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. tax evasion or fraud occurs when taxpayers intentionally. Tax Evasion Penalties Ny.

From www.whalenlawoffice.com

Tax Evasion Penalties What You Need to Know Tax Evasion Penalties Ny tax evasion or fraud occurs when taxpayers intentionally try to avoid taxes they owe. tax evasion is a serious crime in new york as it involves deliberately deceiving the government by avoiding satisfying your tax liabilities. the severity of penalties for tax fraud in new york varies based on the amount of tax evaded and can range. Tax Evasion Penalties Ny.